Tag Archive for: taxes

Tax credits help offset higher education costs

Taxpayers who pay for higher education in 2018 can see tax savings when they file their tax returns. If taxpayers, their spouses or their dependents take post-high school coursework, they may be eligible for a tax benefit.

There are two credits…

A new playing field for business

The Supreme Court’s decision on sales tax collection could give smaller companies that rely on in-store sales a better chance to compete with virtual retailers.

For years, many shoppers in the United States had a choice: buy from an in-state…

2018 Disaster Preparedness Sales Tax Holiday

The 2018 Disaster Preparedness Sales Tax Holiday was passed by the Florida Legislature and signed into law by Governor Rick Scott. This sales tax holiday begins Friday, June 1, 2018 and extends through Thursday, June 7, 2018.

During this…

Check withholding to avoid tax surprises

The Internal Revenue Service encourages taxpayers who typically itemized their deductions on Schedule A of the Form 1040 to use the Withholding Calculator this year to perform a “paycheck checkup.”

People who have itemized before may…

Businesses Get More Time to Challenge IRS Levies

Individuals and businesses have additional time to file an administrative claim or to bring a civil action for wrongful levy or seizure, according to the Internal Revenue Service.

An IRS levy permits the legal seizure and sale of property…

IRS gives taxpayers relief from erroneous HSA contributions

The IRS announced on Thursday that it is modifying the annual limitation on deductions for contributions to a health savings account (HSA) allowed for taxpayers with family coverage under a high-deductible health plan (HDHP) for calendar year…

Se Extiende Fecha Límite para Puerto Rico y las Islas Vírgenes

Se Extiende Fecha Límite de Presentación de Impuestos Hasta el 29 de Junio para Víctimas del Huracán María en Puerto Rico y las Islas Vírgenes.

El Servicio de Impuestos Internos (IRS) les recuerda a las víctimas del huracán María…

Virtual Income Transactions Need to Be Reported to IRS

Income from virtual currency transactions must be reported on individual income tax return, and the IRS says it is scrutinizing these currencies more than ever before.

Virtual currency transactions are taxable by law…

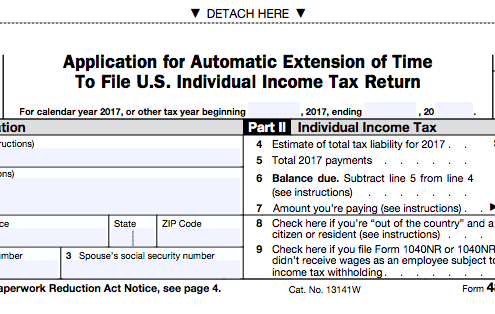

Need More Time for Your Taxes? A 6 Month Extension is Easy

Taxpayers who can't meet the tax filing deadline can use options available via Free File on IRS.gov, to file an extension that gives six more months. The tax deadline this year is April 17. Taxpayers who submit Form 4868, Application for…