The ideal time to review your finances

With the income tax deadline behind them, many Americans are eager to file away their financial records until next year. But experts advise not putting those documents away just yet — now is an opportune time to review them, make any necessary…

Many corporations will pay a blended federal income tax

Many U.S. corporations elect to use a fiscal year end and not a calendar year end for federal income tax reporting purposes. Due to a provision in the recently enacted Tax Cuts and Jobs Act (TCJA), a corporation with a fiscal year that includes…

Se Extiende Fecha Límite para Puerto Rico y las Islas Vírgenes

Se Extiende Fecha Límite de Presentación de Impuestos Hasta el 29 de Junio para Víctimas del Huracán María en Puerto Rico y las Islas Vírgenes.

El Servicio de Impuestos Internos (IRS) les recuerda a las víctimas del huracán María…

Virtual Income Transactions Need to Be Reported to IRS

Income from virtual currency transactions must be reported on individual income tax return, and the IRS says it is scrutinizing these currencies more than ever before.

Virtual currency transactions are taxable by law…

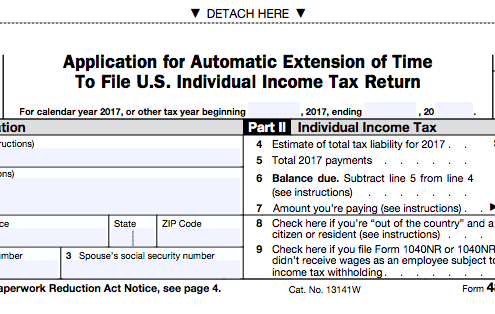

Need More Time for Your Taxes? A 6 Month Extension is Easy

Taxpayers who can't meet the tax filing deadline can use options available via Free File on IRS.gov, to file an extension that gives six more months. The tax deadline this year is April 17. Taxpayers who submit Form 4868, Application for…

Interest on Home Equity Loans Often Still Deductible Under New Law

The Internal Revenue Service today advised taxpayers that in many cases they can continue to deduct interest paid on home equity loans.

Responding to many questions received from taxpayers and tax professionals, the IRS said that despite…

Avoid the Rush: Some Taxpayers May Need Prior-Year Tax Data

The Internal Revenue Service today reminded taxpayers who have changed tax software products that they may need information from their 2016 tax return to complete their taxes this year.

It’s always a good idea to keep copies of previously-filed…

IRS Issues Urgent Warning On New Tax Refund Scam

Just when you thought you'd read about all of the tax scams: The Internal Revenue Service (IRS) is warning taxpayers about a new - and growing - scam involving erroneous tax refunds being deposited into real taxpayer bank accounts. Then the…

2017 Tax Reform Legislation: What You Should Know

The bill will affect the taxes of most taxpayers, but one key point to keep in mind is that for most people, the bill won't affect your taxes for 2017 (the one you file in 2018).

If you’re wondering how you’re affected, not to worry,…