Form 1040 to be shorter but with more schedules

The IRS is working on a draft version of the 2018 Form 1040, U.S. Individual Income Tax Return, that reduces the size of the form to two half-pages in length and eliminates more than 50 lines, compared to the 2017 version of the form. The draft…

Businesses Get More Time to Challenge IRS Levies

Individuals and businesses have additional time to file an administrative claim or to bring a civil action for wrongful levy or seizure, according to the Internal Revenue Service.

An IRS levy permits the legal seizure and sale of property…

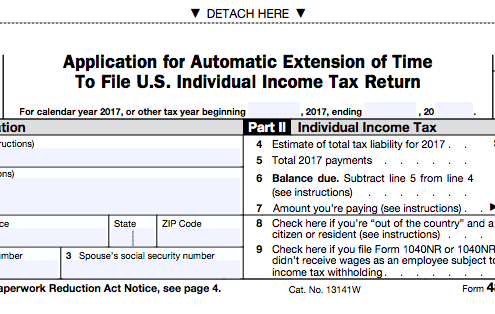

Need More Time for Your Taxes? A 6 Month Extension is Easy

Taxpayers who can't meet the tax filing deadline can use options available via Free File on IRS.gov, to file an extension that gives six more months. The tax deadline this year is April 17. Taxpayers who submit Form 4868, Application for…

IRS Issues Urgent Warning On New Tax Refund Scam

Just when you thought you'd read about all of the tax scams: The Internal Revenue Service (IRS) is warning taxpayers about a new - and growing - scam involving erroneous tax refunds being deposited into real taxpayer bank accounts. Then the…

Identity Protection

Prevention, Detection and Victim Assistance: Tax-related identity theft when someone uses your Social Security number to file a tax return claiming a fraudulent refund.

How to reduce your risk

Always use security software with firewall…

W-2: IRS Payroll Tax Form

If you have paid employees, you must prepare IRS payroll tax forms W-2 and W-3 each year.

Your form W-2 tells the IRS, the Social Security Administration, and the employee the amount of wages and withholding for the year.

The transmittal…

How To Calculate Payroll Taxes

Learn how to withhold, remit, and calculate payroll taxes! If you are a small business owner with employees, you know paying them is not as simple as just writing out a check.

For most employees, you must withhold the following taxes:

…

The most common types of income tax returns

Form 1040 (U.S. Individual Income Tax Return) (a.k.a. “the long form")

Form 1040A (U.S. Individual Income Tax Return) (a.k.a. “the short form")

Form 1040EZ (Income Tax Return for Single and Joint Filers With No Dependents)

…