What is the Social Security Fairness Act (Act) and who does it help?

The Act was signed into law on January 5, 2025.

The Act ends the Windfall Elimination Provision (WEP) and Government Pension Offset (GPO). These provisions reduced or eliminated the Social Security benefits of over 3.2 million people who receive a pension based on work that was not covered by Social Security (a “non-covered pension”) because they did not pay Social Security taxes. This law increases Social Security benefits for certain types of workers, including some:

- teachers, firefighters, and police officers in many states;

- federal employees covered by the Civil Service Retirement System; and

- people whose work had been covered by a foreign social security system.

Learn more below about the steps the Social Security Administration (SSA) is taking to implement the law.

Will every teacher, firefighter, police officer, or public worker receive a benefit increase because of the new law?

Not necessarily. We know that some press articles have mentioned teachers, firefighters, police officers, and other public employees when discussing the new law. However, only people who receive a pension based on work not covered by Social Security may see benefit increases. Most state and local public employees – about 72 percent – work in Social Security-covered employment where they pay Social Security taxes and are not affected by WEP or GPO. Those individuals will not receive a benefit increase due to the new law.

When will a person see their Social Security benefit increase because of the Social Security Fairness Act?

Starting February 25, 2025: SSA is beginning to pay retroactive benefits and will increase monthly benefit payments to people whose benefits have been affected by the WEP and GPO.

If a beneficiary is due retroactive benefits as a result of the Act, they will receive a one-time retroactive payment, deposited into the bank account SSA has on file, by the end of March. This retroactive payment will cover the increase in their benefit amount back to January 2024, the month when WEP and GPO no longer apply.

Social Security benefits are paid one month behind. Most affected beneficiaries will begin receiving their new monthly benefit amount in April 2025 (for their March 2025 benefit).

Anyone whose monthly benefit is adjusted, or who will get a retroactive payment, will receive a mailed notice from Social Security explaining the benefit change or retroactive payment.

NOTE: A beneficiary may receive two mailed notices, the first when WEP or GPO is removed from their record, and a second when their monthly benefit amount is adjusted for their new monthly payment amount. They may receive the retroactive payment before receiving the mailed notice.

We have been able to expedite payments due to the use of automation. For the many complex cases that cannot be processed automatically, additional time is required to manually update the records and pay both retroactive benefits and the new benefits amount.

We urge beneficiaries to wait until April to inquire about the status of their retroactive payment, since these payments will process incrementally throughout March.

Beneficiaries should also wait until after receiving their April payment before contacting SSA to ask about their monthly benefit amount because the new amount will not be reflected until April for their March payment.

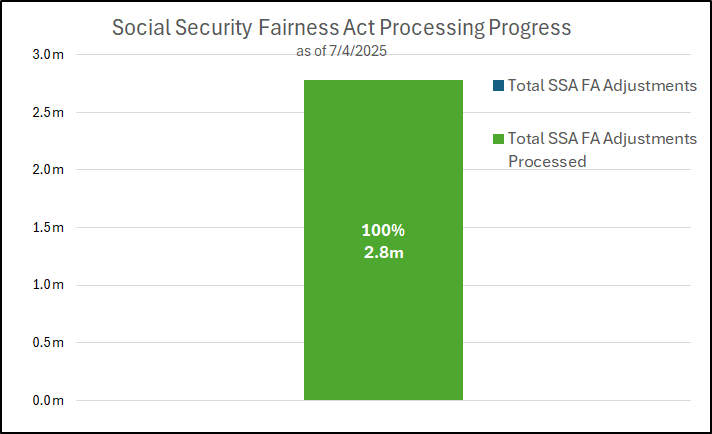

The chart below shows SSA’s progress with processing adjustments since February 25, 2025.

By how much may a person’s monthly benefit increase?

The amount monthly benefits may change can vary greatly. Depending on factors such as the type of Social Security benefit received and the amount of the person’s pension, some people’s benefits will increase very little while others may be eligible for over $1,000 more each month.

AUTHOR: SSA

Call WXC for more details.