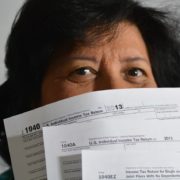

FORMS? What are they for?

You will find the form you need for different activities and process.

Individual Forms:

– Form 1040: US Individual Income Tax Return

– Form W-9: Request for Taxpayer Identification Number (TIN) and Certification .

– Form W-4: Employee’s Withholding Allowance Certificate

– Form 9465: Use this form to request a monthly installment plan if you cannot pay the full amount you owe shown on your tax return (or on a notice we sent you).

– Form W-7: Application for IRS Individual Taxpayer Identification Number.

– Form 4506-T : Request for Transcript of Tax Return free of charge.

– Form 8822: Change of Address.

Business Forms:

– Form 941: Employer’s Quarterly Federal Tax Return

– Form W-4: Employee’s Withholding Allowance Certificate

– Form W-2: Wage and Tax Statement

– Form SS-4: Application for Employer Identification Number (EIN)

– Form 1099-MISC: Miscellaneous Income

– Form 940: Employer’s Annual Federal Unemployment (FUTA) Tax Return.