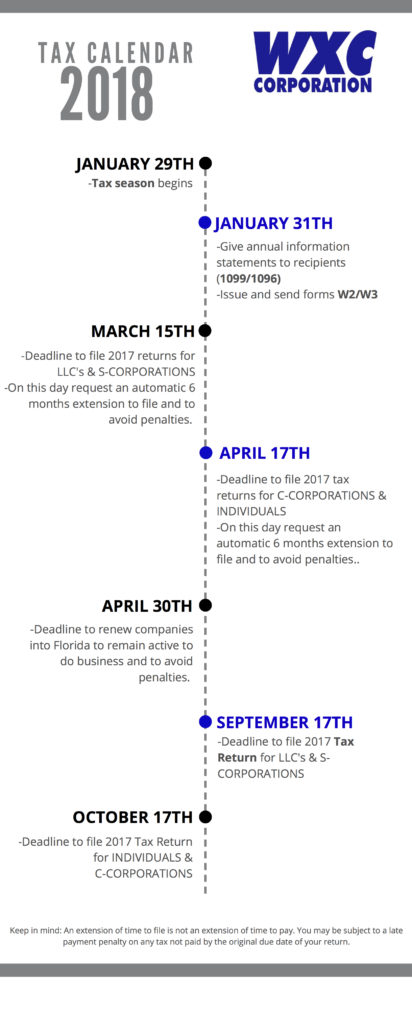

Filing taxes in 2018: Important dates you need to know related to your taxes

In general, all businesses operating in the U.S. are required to report their activities to the IRS by filing annual tax returns. The due date and type of tax return that is filed depends on the type of business entity.

If a business cannot file on time, Form 7004 should be submitted to request a tax extension. Form 7004 must be filed by the original due date of the business’ tax return. Depending on the type of business, the IRS will grant a five- or six-month extension period, beginning on the date the tax return was originally due.

In the case of personal taxes, if you are not able to file your federal individual income tax return by the due date, you may be able to get an automatic 6-month extension of time to file. To do so, you must file Tax Form 4868 by the original due date for filing your tax return (April 17th).

Form 4868 is a tax extension for individuals reporting their income to the IRS. This includes all taxpayers who file 1040s, contractors who file 1099s, as well as single-member LLCs and Schedule C Sole Proprietors. Filing an individual tax extension will extend your tax deadline to October 17 for the following income tax returns:

- Tax Form 1040

- Tax Form 1040A

- Tax Form 1040EZ

- Tax Form 1040NR

- Tax Form 1040NR-EZ

- Tax Form 1040-PR

- Tax Form 1040-SS

Now you can check the calendar with the most important dates you need to know related to your taxes.

You also can download here: INFOGRAFIA 2018