Need More Time for Your Taxes? A 6 Month Extension is Easy

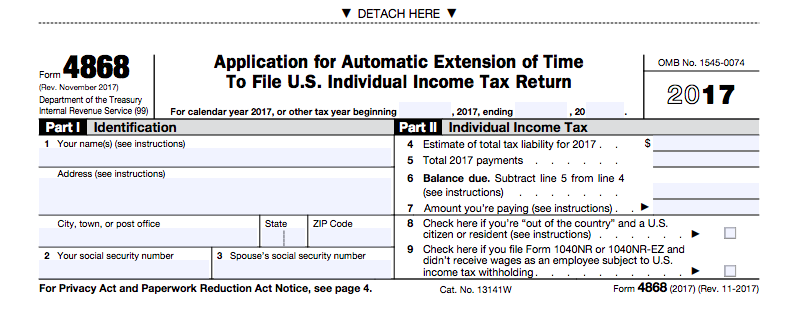

Taxpayers who can’t meet the tax filing deadline can use options available via Free File on IRS.gov, to file an extension that gives six more months. The tax deadline this year is April 17. Taxpayers who submit Form 4868, Application for Automatic Extension of Time to File U.S. Individual Income Tax Return, will automatically be granted a six-month filing extension. By using Free File on IRS.gov, the process is free, simple and fast.

You Still Have to Pay

While the IRS will grant anyone the 6 month extension, and without asking for reasons, that is only an extension of the time to finish collecting all of your documents and filing the appropriate tax forms. The taxpayer must make an estimated payment of any taxes due, or face late payment penalties and potential interest.

Applying for an extension requires answering a few questions on Form 4868. Part I of the form asks personal information such as name, address and Social Security number. Part II is tax related and asks about estimated tax liability, payments and residency. By going through Free File on IRS.gov, taxpayers can make the request electronically for free. Besides Free File, taxpayers can request an extension through a paid tax preparer, tax-preparation software or by mailing in a paper Form 4868. Tax forms can be downloaded from IRS.gov/forms.

Other fast, free and easy ways to get an extension include using IRS Direct Pay, the Electronic Federal Tax Payment System or by paying with a credit or debit card. There is no need to file a separate Form 4868 extension request when making an electronic payment and indicating it is for an extension. The IRS will automatically count it as an extension.

The IRS emphasizes that a request for an extension provides extra time to file a tax return, but not extra time to pay any taxes owed. Payments are still due by the original deadline. Taxpayers should file even if they can’t pay the full amount. By filing either a regular return or requesting an extension by the April 17 filing deadline, they will avoid the late-filing penalty, which can be 10 times as costly as the penalty for not paying.

Taxpayers who pay as much as they can by the due date reduce the overall amount subject to penaltyand interest charges. The interest rate is currently five percent per year, compounded daily. The late-filing penalty is typically five percent per month and the late-payment penalty is normally 0.5 percent per month.

Other options to pay such as getting a loan or paying by credit card may help resolve a tax debt. Most people can set up an installment agreement with the IRS using the Online Payment Agreement tool on IRS.gov.

- U.S. citizens and resident aliens living and working abroad have until June 15 to file their tax returns. However, interest is still charged on any tax payments made after April 17.

- Disaster victims, including those in American Samoa, Puerto Rico and the Virgin Islands, have until June 29, 2018 to file and pay. Similarly, taxpayers in parts of California have until April 30, 2018 to file and pay. For information about this and other disaster relief, see the disaster relief page on IRS.gov.

- Members of the military on duty outside the United States and Puerto Rico receive an automatic two-month extension to file. Those serving in combat zones have 180 days after they leave the combat zone to file tax returns and pay any taxes due. Details are available in the Armed Forces’ Tax Guide Publication 3.

In addition to having payment options, taxpayers who find that they can’t pay what they owe should know that the IRS will work with them. Taxpayers can find answers to questions, forms and instructions and easy-to-use tools online at IRS.gov anytime. No appointments needed and no waiting on hold.

SOURCE: http://www.cpapracticeadvisor.com/news/12404491/need-more-time-for-your-taxes-a-6-month-extension-is-easy

http://www.cpapracticeadvisor.com/